A look into 3rd Quarter 2023 – A Mixed Bag of Candy!

Here at Source Strategies, results for the 3rd quarter of 2023 are being finalized, and we find that amongst the Top 5 Texas Metro Areas, results are mixed! We have strong results in the DFW metroplex, and the wider Houston Metropolitan Area, but San Antonio & Austin have slipped significantly versus 3rd quarter 2022 results.

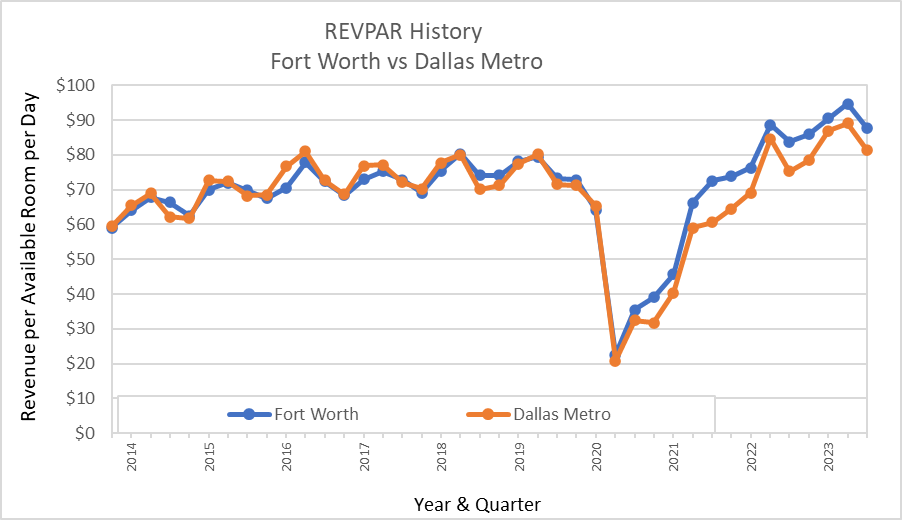

Looking first at the Dallas Metro, versus 3rd Q 2022 we show that REVPAR has risen 8%, rates rose 7.5%, and occupancy was up 0.5% to 64% on average. Fort Worth performed similarly, with REVPAR rising 4.9%, rates up 4.7%, and occupancy rising 0.2% to 66%, on average:

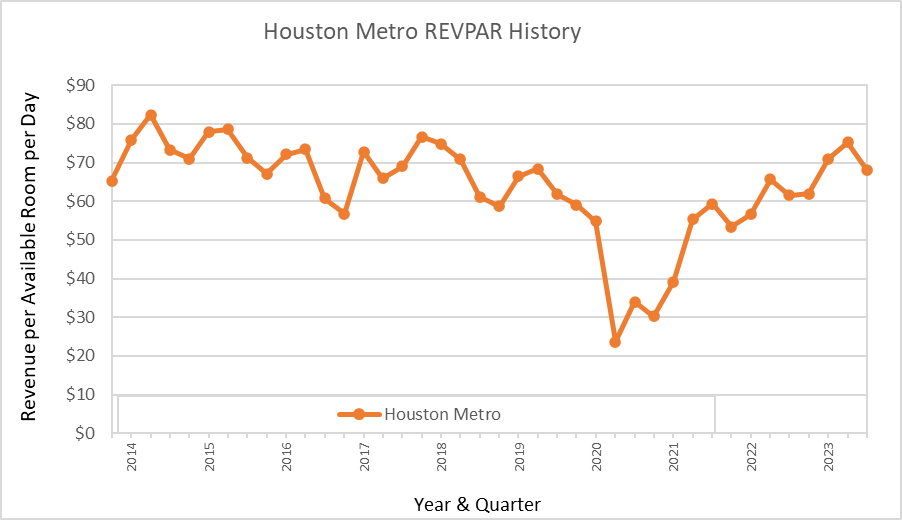

Staying on a positive track, the Houston Metro showed REVPAR up 8.3%, rates rose 7.2%, and occupancy for the 3rd quarter of 2023 rose 1% to 58%.

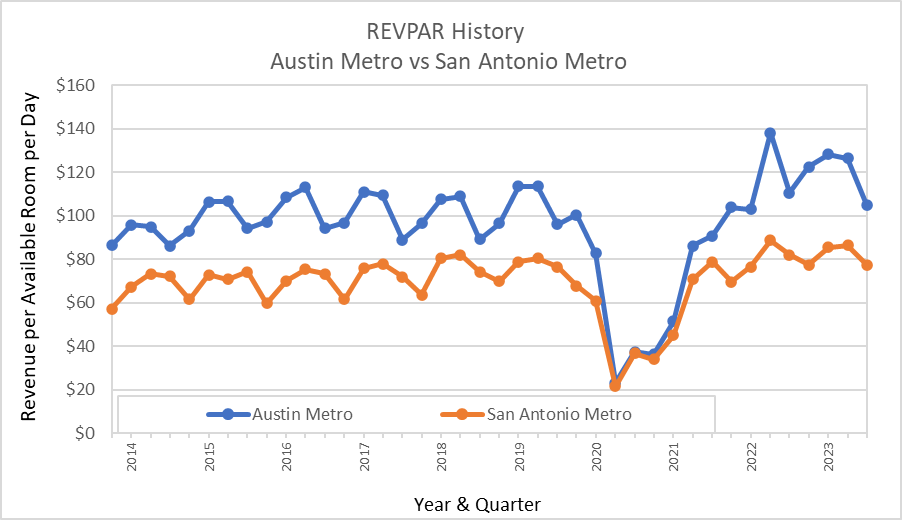

Getting down to the candy nobody wants, we show declines in performance in both the San Antonio and Austin Metro Areas. Taking a look at Austin, we find 3rd quarter 2023 REVPAR versus 3rd quarter 2022 to be down 2.6%, rates up 2%, and occupancy falling 4.5%. Similarly, San Antonio Metro REVPAR fell 7.1%, rates rose 0.2%, and occupancy fell a steep 7.3%. These performances could be considered the black licorice of the season:

Source Strategies Hospitality Industry News

The latest developments from Source Strategies about the Texas Hospitality Industry.